Punta Cana has emerged as one of the Caribbean’s most attractive real estate destinations for investors seeking strong rental yields and long-term property appreciation. With over 8 million tourists visiting annually and infrastructure expanding rapidly, this resort hotspot in the Dominican Republic presents unique opportunities for real estate buyers — especially those targeting short-term vacation rentals.

For investors working within a $500,000 budget, the market is full of options, particularly hotel-managed condos and resort-style villas. These properties combine affordability with income-generating potential, thanks to high occupancy rates, tourist appeal, and access to property management services that make ownership relatively hands-off.

This guide dives into Punta Cana’s top neighborhoods for real estate investment under $500K. Whether you’re seeking high rental yields, future appreciation, or a blend of lifestyle and cash flow, the areas featured here stand out for their unique investment profiles. From beachfront condos to golf communities and emerging “smart cities,” each offers compelling reasons to consider a purchase.

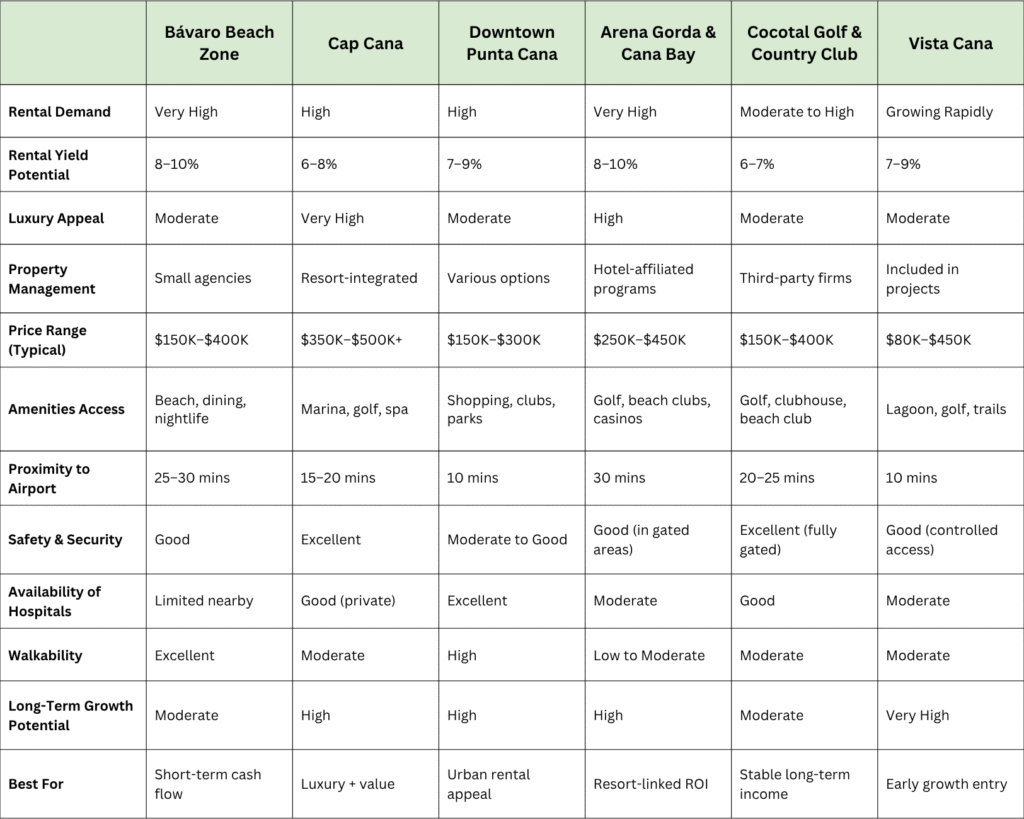

Punta Cana Neighbourhood Investment Comparison Table

El Cortecito & Los Corales (Bávaro Beach Zone)

Nestled within the heart of Bávaro, the beachfront neighborhoods of El Cortecito and Los Corales are two of Punta Cana’s most vibrant and sought-after zones for short-term vacation rentals. Known for their walkable layout, thriving expat communities, and close proximity to white-sand beaches, these areas are ideal for investors looking for high rental income at accessible price points.

Vibrant Beachfront Community

El Cortecito and Los Corales offer the quintessential Caribbean beach lifestyle — without the need for a car. Residents and vacationers alike enjoy walking to restaurants, beach bars, local grocery stores, and the turquoise waters of Bávaro Beach. The atmosphere is relaxed and social, making it a magnet for tourists seeking convenience, authenticity, and fun.

The neighborhoods are popular with North American and European visitors who prefer boutique-style stays over large resorts. This consistent tourist flow fuels strong demand for short-term rentals throughout the year, particularly via platforms like Airbnb and Booking.com.

Rental Demand & Yield Potential

El Cortecito and Los Corales rank among Punta Cana’s top-performing areas for rental income. Thanks to high tourist traffic and limited inventory, many properties achieve annual occupancy rates exceeding 70–80%, with rental yields reportedly reaching up to 10% in some cases.

Properties in this area tend to be managed by either individual hosts or small hotel-style management companies, offering flexibility in how owners monetize their investments. This makes the area especially attractive to hands-on investors who want to operate short-term rentals or to those seeking a fully managed setup.

Affordability and Accessibility

One of the biggest advantages of investing in this zone is the relatively low entry cost. Buyers can find one- or two-bedroom condos starting around $150,000 to $300,000 — well within the sub-$500K range. Even some smaller beachfront units are occasionally available under $400,000, offering exceptional value for a property just steps from the sand.

With its winning mix of affordability, beach access, rental performance, and lifestyle appeal, El Cortecito and Los Corales remain top choices for investors focused on generating reliable cash flow in a well-established tourist area.

Cap Cana (Luxury Gated Community)

For investors who prioritize luxury, security, and long-term appreciation, Cap Cana stands out as one of the most prestigious and promising neighborhoods in Punta Cana. This master-planned, gated community is home to upscale condos, resort villas, and branded residences — all surrounded by some of the Caribbean’s most beautiful natural settings and high-end amenities.

Luxury Living and High-End Appeal

Cap Cana is designed for affluent living. The area features a world-class marina, top-tier golf courses (including the award-winning Punta Espada), fine dining, boutique shopping, and pristine beaches like the iconic Juanillo Beach. These upscale touches appeal to high-net-worth travelers who are willing to pay premium nightly rates for vacation stays.

Real estate in Cap Cana caters to discerning investors, with properties often tied to luxury hotel brands or resort-style developments that offer full property management. This makes it easy for buyers to maintain their investments remotely while still attracting high-paying guests.

Strong Appreciation Outlook

Cap Cana is not only a lifestyle choice but also a smart financial play. Property values in the area have seen consistent growth, and projections for 2024–2028 suggest an annual appreciation rate of around 2.7%. This is fueled by continued infrastructure investments, high-quality new developments, and Cap Cana’s growing reputation as the “Beverly Hills of the Caribbean.”

Though the community is known for multi-million-dollar villas, there are still opportunities for entry-level investors. Smaller condos or resort-branded residences can often be found in the $300K–$500K range, allowing you to secure a position in a high-value market before prices climb further.

Rental Income and Resort Management

Even with higher purchase prices, Cap Cana delivers solid rental returns. The exclusivity and high-end positioning of the area attract a consistent flow of well-off tourists, often looking for luxurious alternatives to traditional all-inclusive resorts. Many properties in Cap Cana are integrated into hotel rental pools or offer dedicated property management services, making them ideal for passive investors.

Whether you’re aiming to diversify your portfolio with a luxury asset or capitalize on the Dominican Republic’s thriving tourism industry, Cap Cana offers a unique combination of prestige, income, and future growth potential.

Downtown Punta Cana (City Center)

Downtown Punta Cana, often referred to as Punta Cana Village or simply “the city center,” is quickly transforming into one of the most dynamic and strategically located areas for real estate investment. Though not beachfront, its proximity to the airport, modern infrastructure, and rapid commercial development make it a smart choice for investors seeking affordable condos with strong rental appeal.

Urban Amenities and New Developments

The downtown area has evolved beyond a simple gateway to the resorts. It now boasts shopping malls, international schools, hospitals, fitness centers, nightclubs like Coco Bongo, and family attractions such as the Katmandu theme park. This urban lifestyle — rare in resort towns — appeals to both tourists and long-term residents, including remote workers and expats.

New residential developments are designed with this lifestyle in mind. Projects like Aria Suites & Residences and others blend resort-style amenities with urban convenience: rooftop pools, co-working lounges, wellness centers, and retail spaces all in one. These features enhance rental desirability and help properties command premium nightly rates, even without beachfront access.

Tourist Appeal and Convenience

One of downtown’s strongest advantages is its unbeatable location. Just 5–10 minutes from Punta Cana International Airport and within a short drive of Bávaro Beach, it offers an ideal home base for travelers who want easy access to both city amenities and resort experiences.

This location also attracts short-term renters seeking convenience — especially digital nomads, business travelers, and vacationers who value nightlife, entertainment, and infrastructure over direct beach access. As Punta Cana’s tourist arrivals continue to grow, downtown rentals are seeing increasing demand throughout the year.

Affordable Modern Condos

Compared to beachfront zones, Downtown Punta Cana offers significantly lower property prices. Investors can find sleek, newly constructed one- and two-bedroom condos ranging from $150,000 to $300,000, well within the under-$500K target. These properties often come with hotel-style services or offer partnerships with rental management companies, allowing for hands-off ownership.

The combination of affordability, modern design, and prime location make downtown a compelling choice for investors looking for value, versatility, and a foothold in one of Punta Cana’s fastest-growing zones.

Arena Gorda & Cana Bay (Resort District)

Located on the northern stretch of Bávaro Beach, Arena Gorda and the adjacent Cana Bay community offer a unique investment opportunity tied closely to Punta Cana’s booming resort tourism. Known for their proximity to iconic all-inclusive resorts and golf courses, these areas are increasingly popular with investors targeting short-term, hotel-style rental income.

Proximity to Major Resorts

Arena Gorda is home to some of Punta Cana’s largest and most recognized resorts, including the Hard Rock Hotel and RIU properties. This high tourist volume generates consistent foot traffic and a strong base of renters looking for alternatives to the traditional resort experience. Many vacationers prefer the space, privacy, and value offered by private condos or villas in the nearby residential zones.

Cana Bay, located right next to the Hard Rock Hotel, is a planned golf resort community that includes modern condo buildings, luxury villas, and access to exclusive amenities like a private beach club. This integration with the resort infrastructure enhances both the experience for renters and the investment potential for property owners.

Resort-Like Amenities and Golf Access

Cana Bay is designed to provide a resort-style lifestyle to residents and guests. The community includes a Jack Nicklaus-designed golf course, infinity pools, fitness centers, and shuttle access to private beach areas. Many developments come with optional property management and rental programs, making it easy for investors to generate income without the hassle of day-to-day hosting.

These amenities not only attract tourists but also justify higher nightly rates. Renters seeking a resort-style experience — without the crowds or restrictions of an all-inclusive — are willing to pay a premium for the privacy and comfort of a condo within walking distance to golf, casinos, and the beach.

High ROI from Vacation Rentals

Arena Gorda and Cana Bay have emerged as some of the highest-performing areas in Punta Cana for rental returns. Thanks to their resort-adjacent locations and growing popularity, annual rental yields of 8–10% are commonly reported. These figures are especially strong when properties are professionally managed and marketed through platforms like Airbnb or included in resort rental pools.

Prices in the area are still competitive. Many units in Cana Bay and surrounding developments are available in the $250K–$450K range, offering investors the chance to buy into a high-demand zone with strong upside potential. As development continues and tourism grows, this area is expected to remain a top-tier investment hotspot.

Cocotal Golf & Country Club

For investors seeking a balance of tranquility, community living, and steady rental returns, Cocotal Golf & Country Club offers a compelling alternative to Punta Cana’s busier beach zones. Located in Bávaro, this well-established gated golf community is built around a lush 27-hole course and is known for its secure, family-friendly atmosphere.

Established Gated Golf Community

Cocotal has been a cornerstone of Bávaro’s residential scene for over two decades. Its mature landscaping, paved roads, and consistent maintenance distinguish it from newer developments still under construction. The neighborhood attracts both short-term renters — particularly golf tourists — and long-term residents, including retirees and expat families.

Security is a major highlight. The community is fully gated with 24/7 surveillance and controlled access, giving owners and guests peace of mind. Inside, the ambiance is relaxed and green, with golf course views, quiet walking paths, and low traffic — perfect for those who prioritize comfort and safety.

Reliable Long-Term Rental Income

Unlike beachfront zones that fluctuate seasonally, Cocotal tends to attract longer-term renters, including snowbirds, remote workers, and families staying for several months at a time. This steady demand translates into reliable cash flow and reduced vacancy rates, making it ideal for investors who value income stability over volatile high-season earnings.

The growing popularity of golf tourism in the Dominican Republic adds another layer of demand. Visitors traveling specifically for golf vacations often book well in advance and stay longer, especially during the winter months. Many owners in Cocotal structure their rental calendars around these extended stays, which often come with less turnover and maintenance hassle.

Value and Lifestyle Perks

While Cocotal may not offer oceanfront views, it compensates with a suite of attractive amenities. Residents and guests enjoy access to pools, a clubhouse, restaurants, a mini-market, and fitness facilities. One of the biggest perks is exclusive access to a private beach club across the road at the Melia resort — including discounts on all-inclusive day passes, which adds substantial value for renters.

Properties in Cocotal remain relatively affordable, with one-bedroom condos starting around $150,000 and larger villas still comfortably under the $500,000 threshold. The area is ideal for investors seeking lower-risk, medium-term appreciation and consistent rental returns in a quiet, amenity-rich environment.

Vista Cana (Master-Planned Smart City)

Vista Cana is one of Punta Cana’s most exciting emerging developments — a visionary, master-planned “smart city” just 10 minutes from the airport and Downtown Punta Cana. Though it’s located inland rather than along the beach, Vista Cana offers a compelling mix of affordability, amenities, and long-term growth potential, making it an excellent opportunity for forward-thinking investors.

Emerging Community with Upside

Unlike more established neighborhoods, Vista Cana is still in the development phase, which means early investors have the chance to buy at lower prices before the area matures. The master plan envisions a self-sustaining, mixed-use city featuring a wide array of amenities: a saltwater lagoon with an artificial beach, sports courts, bike and eco-trails, fishing lakes, retail and dining zones, schools, and a 9-hole executive golf course.

This broad vision — combining leisure, residential, and commercial features — is designed to attract a diverse mix of tourists, families, digital nomads, and local professionals. As each phase is completed, the community becomes increasingly attractive both as a place to live and as a rental destination.

Modern Villas and Condos Under $500K

Vista Cana offers some of the best price-to-value ratios in the entire Punta Cana region. Condos start under $100,000 in pre-construction, and many well-designed villas fall comfortably below the $500,000 mark. These new builds typically feature modern architecture, smart home technology, resort-style pools, gated access, and landscaped common areas.

Because many of these properties are being built from the ground up, investors can often customize unit features or choose between villa and condo options, depending on their budget and strategy. It’s an ideal opportunity for those looking to secure a stylish, income-generating property in a forward-looking community.

Appealing to Tourists and Locals

While Vista Cana may not offer beachfront access, its “city within a city” concept is a major draw. Tourists are likely to be attracted by its lagoon beach, golf access, and walkable layout. Meanwhile, long-term renters such as families, local workers, or expats benefit from the planned schools, parks, business services, and public transport connections.

This dual-market appeal — short-term vacationers and long-term tenants — positions Vista Cana as a high-occupancy neighborhood with broad rental flexibility. However, since it is still in the construction phase, investors should perform careful due diligence when purchasing pre-construction units. Those who get in early may be rewarded with strong capital appreciation as the development reaches its full potential.

Comparative Analysis of Investment Zones

With so many appealing neighborhoods in Punta Cana, choosing the right one for your investment strategy depends on several key factors — including rental yield, appreciation potential, lifestyle goals, and risk tolerance. This comparative analysis breaks down the major trade-offs among the top zones.

Rental Yield vs Appreciation

If your primary objective is maximizing short-term rental income, beach-adjacent areas like El Cortecito, Los Corales, and Cana Bay offer the strongest yields — often between 8% and 10% annually. These neighborhoods benefit from high tourist traffic, walkability, and proximity to entertainment, making them ideal for Airbnb-style rentals.

On the other hand, areas like Cap Cana and Vista Cana may offer more upside in terms of property value appreciation. Cap Cana’s luxury positioning and infrastructure growth have historically supported steady annual price increases, while Vista Cana’s early-stage development status creates a potential for rapid value gains as the area matures.

Beachfront vs Inland Developments

Beachfront neighborhoods like El Cortecito and Arena Gorda offer immediate appeal to vacationers, often commanding higher nightly rates and faster booking turnover. However, this visibility comes at a premium — beachfront properties tend to be more expensive, competitive, and susceptible to seasonal variations.

Inland zones like Downtown Punta Cana, Vista Cana, and Cocotal offer more year-round flexibility. These areas tend to attract a mix of short-term tourists and longer-term renters (including expats, professionals, and retirees), resulting in steadier occupancy and reduced vacancy risks. They also generally offer better value per square meter and lower operational costs.

Hands-On vs Hotel-Managed Options

Some investors prefer to be involved in managing bookings and optimizing pricing — especially in areas like Los Corales or Downtown where independent hosting is common. Others may favor a more passive approach, relying on hotel-affiliated rental programs or third-party property managers.

Cap Cana, Cana Bay, and many developments in Vista Cana cater well to passive investors by offering built-in rental management services, concierge teams, and turnkey operations. This convenience can be ideal for international buyers who don’t live in the Dominican Republic year-round.

Ultimately, the best neighborhood for your investment depends on your financial goals, time commitment, and risk appetite. Some areas offer high returns but require hands-on management, while others provide lower-maintenance ownership with solid long-term value.

Conclusion

Punta Cana continues to evolve as a world-class real estate destination, offering diverse opportunities for investors with budgets under $500,000. Whether you’re seeking high-yield beachfront condos in El Cortecito, luxury appreciation in Cap Cana, or early-stage growth in Vista Cana, there’s a neighbourhood that aligns with your strategy. With record-breaking tourism, expanding infrastructure, and a steady stream of global interest, 2025 is an ideal time to explore and invest in Punta Cana’s thriving property market. By aligning your financial goals with the right location and property type, you can unlock long-term value, generate consistent rental income, and enjoy a piece of Caribbean paradise